DeFi Yield Aggregator

DeFi Yield Aggregator: Risk-Based Investment Platform

Overview

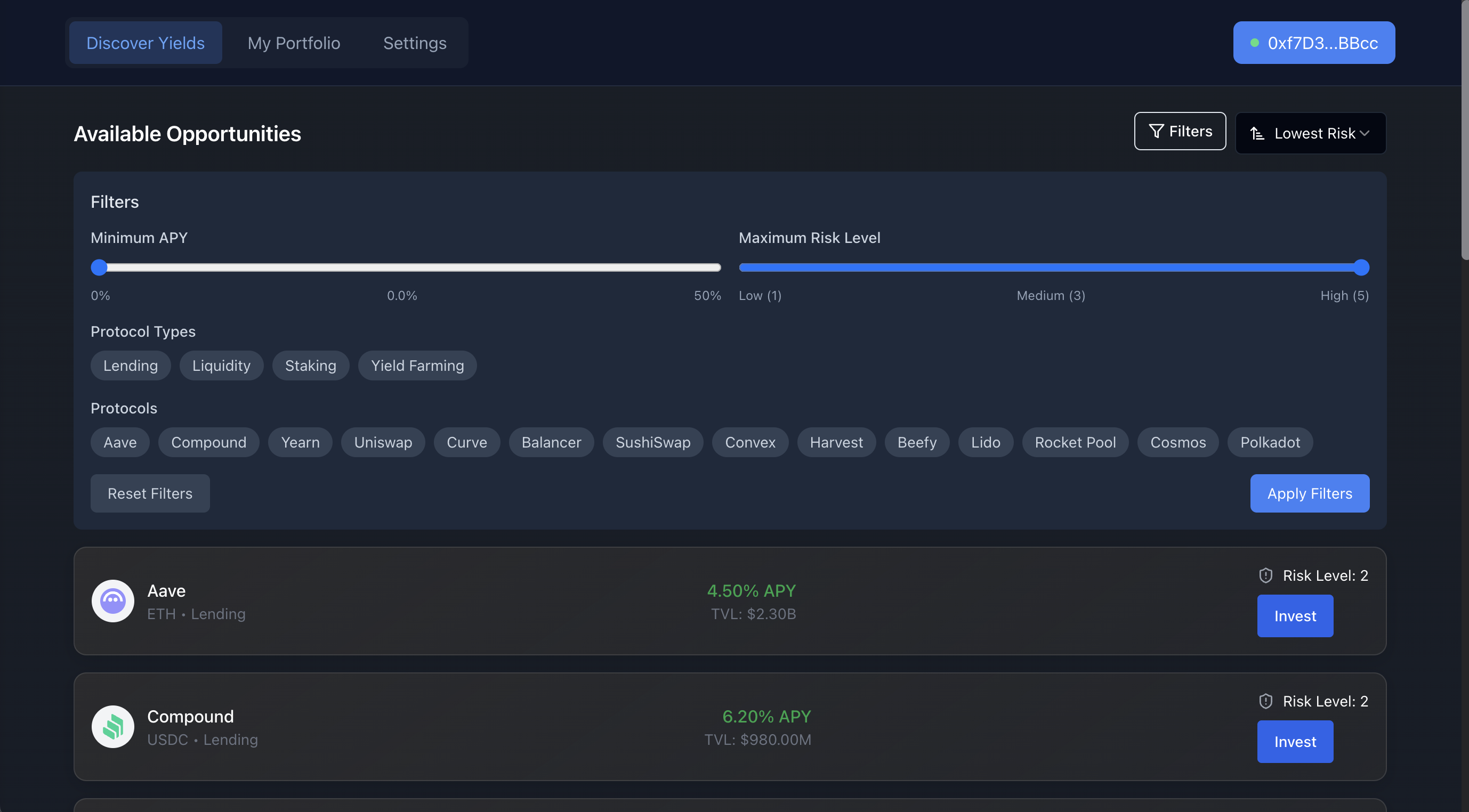

The DeFi Yield Aggregator is a sophisticated platform that simplifies decentralized finance investing by matching yield opportunities to users' risk profiles. By aggregating data from multiple DeFi protocols, analyzing risk parameters, and providing a user-friendly interface, the platform enables both novice and experienced investors to make informed decisions about where to allocate their digital assets for optimal returns within their risk tolerance.

Core Features

Risk-Based Filtering

- Personalized risk assessment questionnaire

- Protocol security scoring from 1-5

- Volatility and impermanent loss evaluation

- Historical performance tracking

- Transparent risk calculation methodology

Multi-Protocol Integration

- Lending protocols (Aave, Compound)

- Liquidity pools (Curve, Uniswap, SushiSwap)

- Yield farming opportunities (Convex, Yearn)

- Staking platforms (Lido, Rocket Pool)

- Cross-chain yield opportunities

Portfolio Management

- Position tracking across protocols

- Performance analytics dashboard

- Yield optimization suggestions

- Historical returns visualization

- Asset allocation recommendations

Smart Contract Interaction

- Seamless wallet integration

- One-click investment deployment

- Gas optimization strategies

- Transaction monitoring

- Auto-compound options

Data Visualization

- Interactive yield comparison charts

- Risk vs. reward visualizations

- Historical APY tracking

- Protocol TVL monitoring

- Portfolio diversification analysis

System Architecture

Frontend Layer

- React application with Web3 integration

- Responsive design for all devices

- Interactive data visualizations

- Wallet connection interface

- Risk assessment questionnaire

Backend Layer

- Node.js/Express API server

- User management system

- Risk analysis engine

- Protocol adapters for DeFi integration

- Performance monitoring service

Blockchain Layer

- Smart contracts for protocol interaction

- Transaction management system

- Gas optimization strategies

- Multi-chain support (Ethereum, L2s, alt-L1s)

- Security measures against common attacks

Data Layer

- Real-time protocol data (TVL, APY)

- On-chain historical performance analysis

- Token price and volatility metrics

- Protocol security scores

- Risk classification parameters

Protocol Integration

Lending Platforms

- Aave: Variable and stable rate lending

- Compound: Algorithmic interest rates

- Secure transaction signing

- Collateral management

- Interest rate monitoring

Liquidity Protocols

- Curve: Stablecoin and like-asset swaps

- Uniswap V3: Concentrated liquidity positions

- Balancer: Customizable pool weights

- LP token tracking and management

- Impermanent loss calculation

Yield Aggregators

- Yearn Finance: Automated yield strategies

- Convex Finance: Curve boosting platform

- Harvest: Farming automation

- Risk/reward comparisons

- Strategy performance tracking

Use Cases

Conservative Investors

- Low-risk stablecoin lending

- Blue-chip protocol focus

- Principal-protected strategies

- Lower but more consistent yields

- Higher security score requirements

Balanced Investors

- Mixed portfolio of lending and LPs

- Moderate risk tolerance

- Diversification across protocols

- Balance between security and yield

- Established protocol preference

Yield Maximizers

- Higher risk tolerance for greater rewards

- Newer protocols with higher APYs

- Farming opportunities with token incentives

- Active portfolio management

- Emerging protocol exploration

DeFi Newcomers

- Educational onboarding process

- Simplified investment options

- Clear risk explanations

- Guided investment process

- Low barrier to entry options

Development Roadmap

Phase 1: Core Infrastructure

- Development environment setup

- Basic UI implementation

- Wallet connection functionality

- Risk assessment questionnaire

- Initial data aggregation framework

Phase 2: Protocol Integration

- Lending protocol integration (Aave, Compound)

- Liquidity protocol integration (Curve, Uniswap)

- Yield aggregator integration (Yearn, Convex)

- Data normalization and comparison system

- Risk/reward analysis implementation

Phase 3: Advanced Features

- Portfolio management dashboard

- Performance analytics

- Advanced risk metrics

- Historical volatility analysis

- Protocol security scoring system

Phase 4: Testing & Polishing

- Comprehensive test suite

- User acceptance testing

- Security audits

- Performance optimization

- Documentation and user guides

Technical Implementation

Wallet Connection

- Web3Modal for multiple wallet options

- WalletConnect integration for mobile

- Ethers.js for blockchain interaction

- Secure provider management

- Account and network detection

Protocol Data Aggregation

- GraphQL queries to The Graph subgraphs

- DeFi Llama API for TVL data

- CoinGecko API for token pricing

- Protocol-specific API integration

- Caching for performance optimization

Risk Calculation Algorithm

- Multi-factor risk assessment

- Protocol age evaluation

- TVL size consideration

- Audit score weighting

- Asset volatility analysis

- Protocol type risk factoring

Smart Contract Development

- Protocol interaction contracts

- Safety-focused code patterns

- Reentrancy protection

- Access control implementation

- Event emission for tracking

Security Implementation

- Multiple independent audits

- Bug bounty program

- Formal verification for critical components

- Progressive deployment with limits

- Regular security scanning

Deployment Architecture

- Frontend: Static hosting on AWS S3 + CloudFront

- Backend: Containerized microservices on AWS ECS

- Database: MongoDB Atlas for protocol and user data

- Blockchain: Premium Infura/Alchemy node access

- Monitoring: Prometheus + Grafana dashboard

The DeFi Yield Aggregator democratizes access to decentralized finance yields by providing a user-friendly platform that matches investment opportunities to individual risk profiles. By aggregating data across multiple protocols and presenting it in an intuitive interface with transparent risk metrics, the platform empowers users to make informed decisions and optimize their returns within their personal risk tolerance.