TrendAI Stock Opportunity Analyser

TrendAI: Stock Opportunity Analyser

Overview

TrendAI is a sophisticated stock analysis platform that identifies trading opportunities by detecting disparities between price trends, fundamental metrics, and market sentiment. Using advanced pattern recognition algorithms and automated technical analysis, the system helps traders make data-driven decisions by highlighting stocks where price movements may not yet reflect underlying strength or weakness. The platform provides clear buy and sell signals with confidence scores, entry and exit targets, and detailed visualizations of key technical indicators.

Core Features

Technical Analysis Engine

- Real-time price trend tracking and visualization

- Multiple moving averages (20, 50, 200-day)

- RSI and MACD momentum indicators

- Bollinger Bands volatility measurement

- Volume trend analysis and breakout detection

- Advanced chart pattern recognition

Pattern Recognition System

- Automated detection of chart patterns (double tops/bottoms)

- Trend identification (higher lows, lower highs)

- Moving average crossovers (golden cross, death cross)

- RSI divergence and overbought/oversold conditions

- Volume-price trend correlation

- Pattern confidence scoring methodology

Signal Generation

- Clear BUY/SELL/NEUTRAL recommendations

- Confidence percentage for each signal

- Price entry, target, and stop-loss levels

- Multiple reasoning factors for each signal

- Signal strength classification system

- Automatic sorting by signal strength

Visualization Dashboard

- Interactive price and indicator charts

- Technical analysis summary panels

- Pattern identification markers

- Multi-timeframe analysis options

- Customizable display preferences

- Mobile-responsive design

Trading Decision Support

- At-a-glance signal summary table

- Calculated risk-reward ratios

- Position sizing recommendations

- Portfolio signal distribution analytics

- Automated price alert system

- One-click detailed analysis access

System Architecture

Data Integration Layer

- Tiingo API for comprehensive financial data

- Historical price data retrieval system

- Fundamental metrics extraction

- News and sentiment data aggregation

- Custom caching and rate limiting management

- Scheduled data refresh pipeline

Analysis Layer

- TrendAnalyzer core analysis module

- PatternDetector for chart pattern recognition

- SignalGenerator for trading signal creation

- Multi-factor scoring algorithm

- Statistical validation procedures

- Confidence calculation engine

Visualization Layer

- ChartGenerator for interactive visualizations

- Plotly-based interactive charts

- Responsive layout system

- Color-coded indicators and signals

- Pattern annotation system

- Automated chart saving functionality

User Interface Layer

- Command-line interface for professional traders

- Browser-based chart viewing capability

- Colored console output for signal clarity

- Batch processing for multiple symbols

- Automatic chart opening for strong signals

- Clear signal summary statistics

Technical Implementation

Data Acquisition

- Tiingo API integration for reliable market data

- Historical price data with adjustments for splits/dividends

- Price, volume, and fundamental metrics processing

- News sentiment analysis with TextBlob NLP

- Error handling and retry mechanisms

- Efficient data caching strategies

Technical Indicators

- Simple and exponential moving averages

- RSI for momentum measurement

- MACD for trend and momentum integration

- Bollinger Bands for volatility assessment

- Stochastic oscillator for overbought/oversold conditions

- Average True Range for volatility quantification

Pattern Detection Algorithms

- Rolling window extrema identification

- Price tolerance and window parameters

- Multi-point validation system

- Confidence scoring based on pattern clarity

- Statistical significance filtering

- Multi-factor pattern confirmation

Signal Generation Logic

- Multi-factor weighted scoring system

- Technical, fundamental, and sentiment integration

- Dynamic threshold determination

- Confidence calculation based on signal strength

- Entry, target, and stop-loss price calculation

- Reason attribution for transparency

Visualization Techniques

- Candlestick charting with volume overlay

- Technical indicator subplot integration

- Signal marker overlays on price charts

- Pattern highlighting with annotations

- Trendline visualization

- Color-coded signal strength indicators

Use Cases

Day Traders

- Rapid identification of intraday opportunities

- Pattern-based entry and exit signals

- Clear stop-loss and target recommendations

- Volume-price confirmation signals

- Multiple timeframe analysis options

- Quick-view technical summary panels

Swing Traders

- Multi-day/week trade opportunity identification

- Trend reversal detection for optimal entries

- Pattern completion monitoring

- Position establishment strategies

- Profit-taking level recommendations

- Risk-reward optimization tools

Fundamental Investors

- Technical timing for fundamentally-sound stocks

- Entry point optimization for long-term positions

- Divergence between price and fundamentals

- Sentiment-price misalignment detection

- Market timing for portfolio rebalancing

- Risk management signals for existing positions

Financial Analysts

- Quantitative support for qualitative analysis

- Pattern-based market cycle identification

- Cross-asset correlation tracking

- Market sentiment quantification

- Technical validation of fundamental theses

- Signal clustering for sector rotation strategies

Highlighted Capabilities

Interactive Analysis Charts

- Comprehensive technical indicators display

- Buy/sell signal annotations

- Pattern identification markers

- Support/resistance level visualization

- Moving average trendlines

- Volume-price relationship indicators

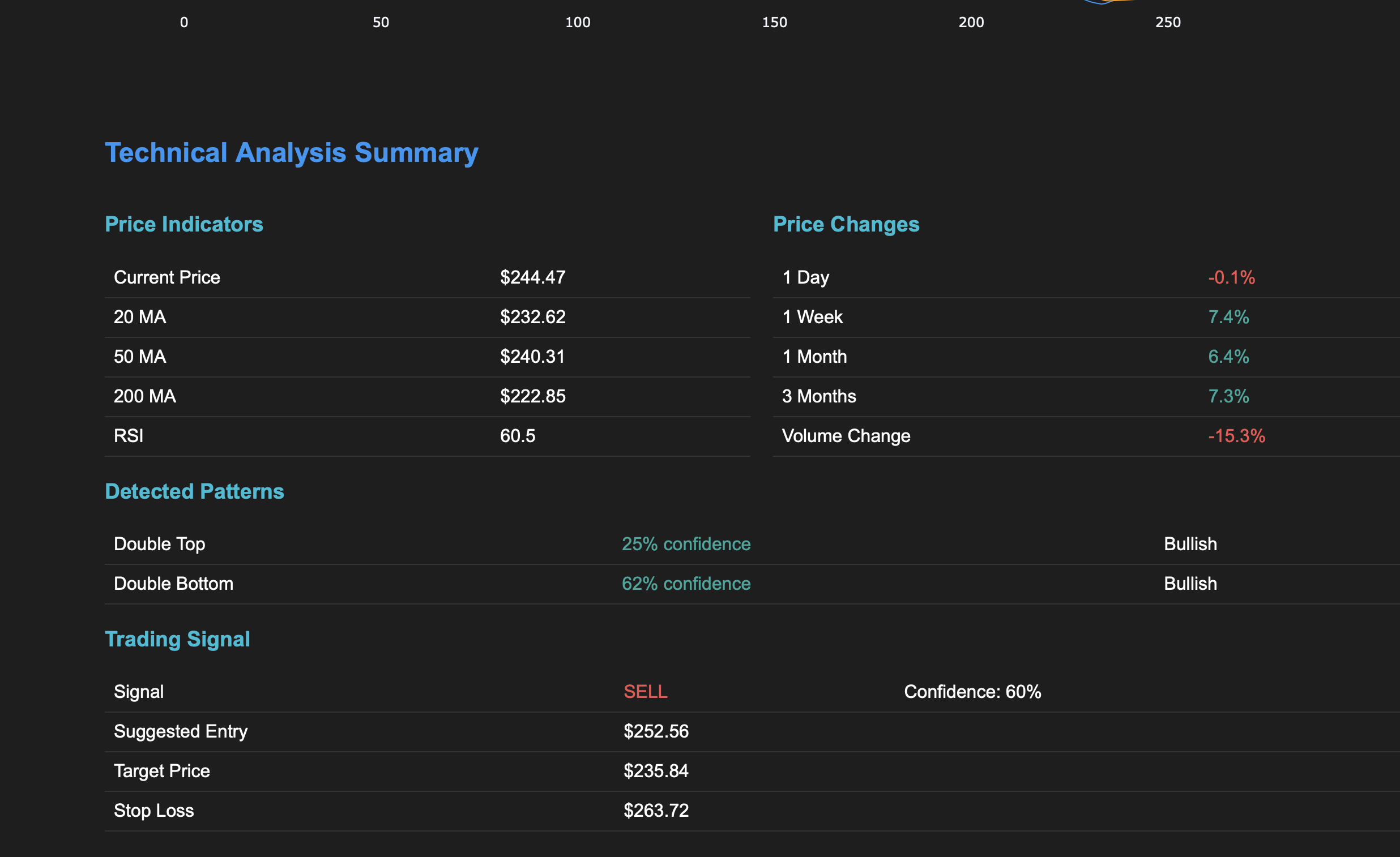

Technical Analysis Summary

- Current price and key moving averages

- RSI and momentum indicator values

- Price changes across multiple timeframes

- Volume trend analysis

- Pattern detection with confidence scores

- Signal summary with entry/exit guidance

Signal Classification System

- STRONG_BUY: High-confidence bullish signals

- BUY: Moderate-confidence bullish signals

- NEUTRAL: Balanced or unclear market conditions

- SELL: Moderate-confidence bearish signals

- STRONG_SELL: High-confidence bearish signals

Pattern Recognition Capabilities

- Double Top/Bottom: Reversal patterns

- Head & Shoulders: Complex reversal patterns

- Higher Lows/Lower Highs: Trend continuation patterns

- Golden/Death Cross: Moving average crossovers

- RSI Divergence: Momentum vs. price discrepancies

- Volume Breakouts: Significant volume-driven moves

Development Roadmap

Phase 1: Core Analysis Engine

- Tiingo API integration for market data

- Basic technical indicator implementation

- Initial pattern detection algorithms

- Simple signal generation system

- Command-line interface

Phase 2: Enhanced Analysis

- Advanced pattern detection refinement

- Multi-factor signal scoring

- Technical summary panel development

- Interactive chart generation

- Signal confidence calculation improvements

Phase 3: Advanced Features

- Portfolio analysis capabilities

- Multi-timeframe signal integration

- Backtesting functionality

- Performance analytics

- Custom alert system

Phase 4: Platform Expansion

- Web interface development

- Real-time data streaming

- Mobile application

- Social sharing capabilities

- Institutional-grade data integrations

TrendAI Stock Opportunity Analyzer transforms complex technical analysis into actionable trading signals through its advanced pattern recognition and multi-factor analysis system. By integrating price trends, fundamental metrics, and market sentiment, the platform helps traders identify opportunities where market inefficiencies may exist, providing a significant edge in today's fast-moving financial markets.