AI Hedge Fund

AI Hedge Fund: Multi-Agent Trading System

Overview

The AI Hedge Fund is a sophisticated proof-of-concept that leverages multiple specialized AI agents to make data-driven trading decisions. Operating as a collaborative system, these agents analyze different market aspects—from technical indicators to fundamental valuations and market sentiment—to identify trading opportunities with high confidence. The system orchestrates communication between agents through a central decision-making framework that weighs different signals before executing trades, providing a comprehensive approach to automated portfolio management.

Core Features

Multi-Agent Architecture

- Eight specialized trading agents with distinct analysis methodologies

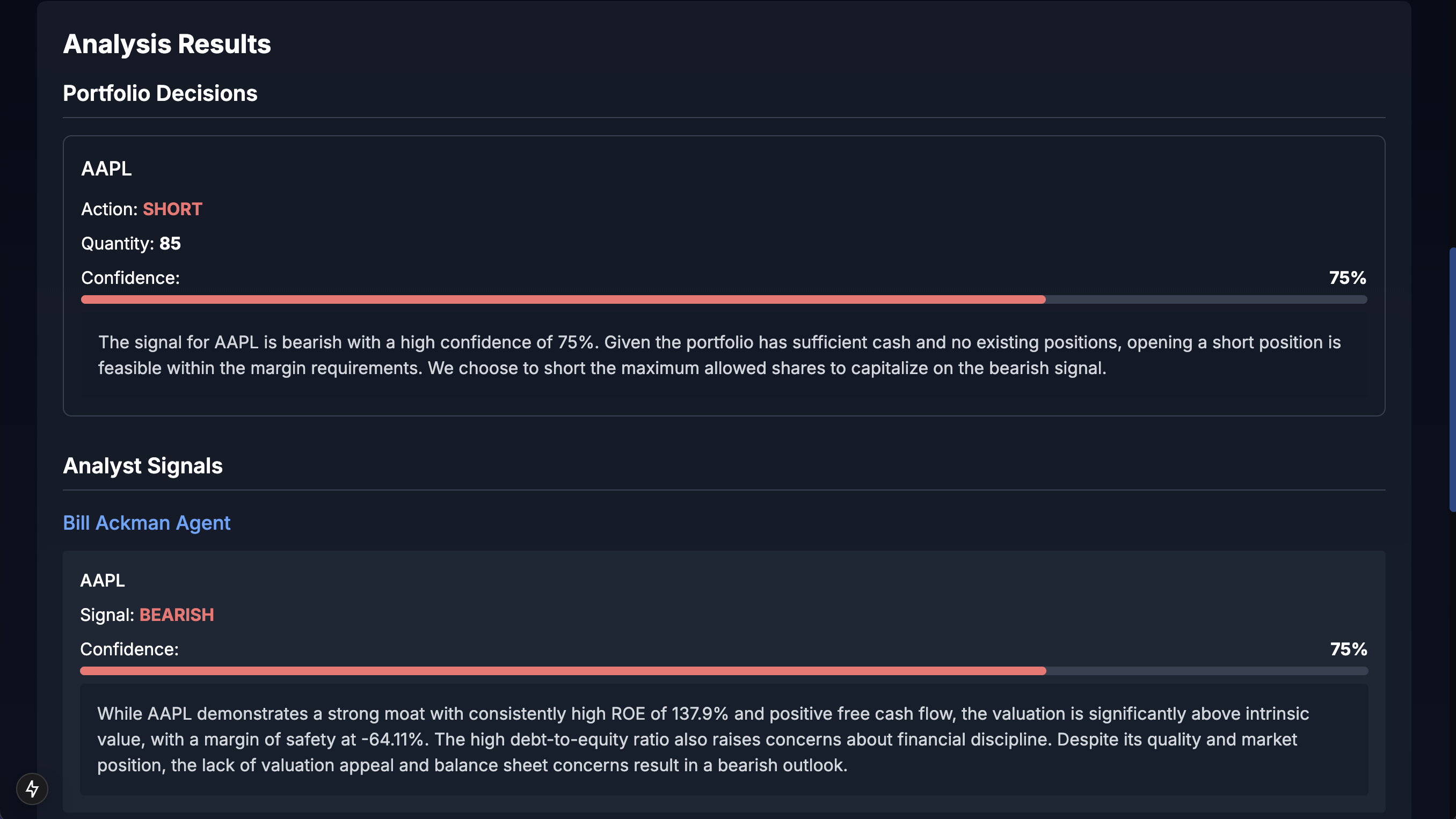

- Bill Ackman Agent for activist investing principles

- Warren Buffett Agent for value investing approach

- More macro agents to be added

- Real-time agent intercommunication framework

- Weighted signal aggregation and confidence scoring

- MCP-style central coordination system

Advanced Analysis Capabilities

- Technical indicator pattern recognition

- Fundamental valuation modeling

- Market sentiment analysis from news and social media

- Volatility and risk assessment tools

- Cross-validation between different analysis methodologies

- Backtesting framework for strategy validation

Portfolio Management

- Dynamic position sizing based on confidence and risk

- Risk-adjusted return optimization

- Asset allocation across multiple securities

- Automated rebalancing recommendations

- Performance tracking and attribution analysis

- Customizable risk tolerance parameters

Signal Generation

- Clear BUY/SELL/NEUTRAL recommendations

- Confidence percentage for each trading signal

- Multiple reasoning factors for transparency

- Cross-agent agreement measurement

- Strength classification system

- Time horizon recommendations

Visualization Dashboard

- Interactive agent decision summary

- Performance metrics and benchmarking

- Risk analytics visualization

- Position tracking interface

- Historical signal accuracy tracking

- Clear signal reasoning explanations

System Architecture

Agent Layer

- Specialized AI agents (Warren Buffett, Bill Ackman, etc.)

- Independent microservice architecture

- Containerized deployment for isolation

- API-based communication endpoints

- Agent-specific knowledge bases and reasoning models

- Specialized language models for each strategy

Data Integration Layer

- Real-time market data via Alpha Vantage, Yahoo Finance

- News and social media feeds for sentiment analysis

- Fundamental data retrieval system

- Technical indicator calculation pipeline

- Custom caching and rate limiting

- Historical data warehouse for backtesting

Processing Layer

- Signal generation algorithms by agent

- Confidence calculation methodologies

- Multi-factor scoring system

- Signal aggregation and weighting

- Pattern recognition systems

- Anomaly detection capabilities

Decision Engine

- Central portfolio management system

- Position sizing optimization

- Risk management framework

- Order generation and validation

- Trade execution simulation

- Performance tracking and analysis

Technical Implementation

Core Framework

- Python backend for AI and data processing

- FastAPI for microservice endpoints

- Docker for containerized deployment

- Kafka/RabbitMQ for event streaming

- MongoDB/PostgreSQL for data storage

- LangChain/CrewAI for agent orchestration

AI Models Integration

- LLM integration (Mistral, Llama, GPT-4)

- Fine-tuned models for financial analysis

- Sentiment analysis with FinBERT

- Technical pattern recognition with custom algorithms

- Statistical validation frameworks

- Confidence calculation methodologies

Data Processing Pipeline

- Real-time market data ingestion

- News API and social media integration

- Technical indicator calculation

- Fundamental data analysis

- Sentiment scoring system

- Data normalization and preprocessing

Agent Communication

- REST API endpoints for agent interaction

- Message queue for asynchronous communication

- Standardized signal format

- Confidence and reasoning metadata

- Weighted feedback mechanisms

- Results caching and persistence

Backtesting Framework

- Historical performance simulation

- Strategy optimization tooling

- Risk-adjusted return calculation

- Drawdown and volatility analysis

- Performance comparison against benchmarks

- Parameter sensitivity testing

Implementation Approach

Agent Definitions

Warren Buffett Agent

- Value investing principles focus

- Long-term quality business identification

- Margin of safety calculation

- Competitive advantage assessment

- Management quality evaluation

- Fundamental analysis priority

Bill Ackman Agent

- Activist investing approach

- Concentrated position strategies

- Catalyst identification

- Corporate governance analysis

- Management engagement strategy

- Event-driven opportunity focus

Valuation Agent

- Intrinsic value calculation (DCF)

- Multiple-based comparative analysis

- Growth projection models

- Margin expansion tracking

- Free cash flow analysis

- Return on capital assessment

Sentiment Agent

- News headline sentiment scoring

- Social media trend analysis

- Analyst rating aggregation

- Earnings call sentiment evaluation

- Market narrative tracking

- Contrarian indicator assessment

Technical Agent

- Chart pattern recognition

- Support/resistance identification

- Momentum indicator calculation

- Moving average crossovers

- Volume analysis and price correlation

- Bollinger Band and volatility measurement

Development Roadmap

Phase 1: Core Infrastructure

- Agent framework implementation

- Data retrieval system setup

- Basic UI for configuration and results

- Individual agent logic development

- Signal format standardization

- Initial backtesting framework

Phase 2: Enhanced Analysis

- Advanced agent reasoning capabilities

- Multi-factor signal generation

- Confidence scoring refinement

- Inter-agent communication protocols

- Decision engine weighting system

- Performance analytics dashboard

Phase 3: System Optimization

- Machine learning for signal optimization

- Dynamic agent weighting based on performance

- Advanced risk management capabilities

- Extended market condition detection

- Strategy adaptation frameworks

- Comprehensive simulation environment

Phase 4: Deployment & Scaling

- Microservice architecture implementation

- Containerized agent deployment

- Cloud-based scaling capabilities

- Real-time data streaming enhancements

- UI/UX improvements for visualization

- Extended backtesting capabilities

Highlighted Capabilities

Interactive Analysis Dashboard

- Agent decision summaries with reasoning

- Signal strength visualization

- Portfolio composition view

- Risk metrics dashboard

- Performance tracking against benchmarks

- Trade history with signal attribution

Multi-Agent Decision Making

- Weighted signal aggregation

- Cross-validation between agents

- Confidence-based position sizing

- Consensus and dissent measurement

- Agent performance tracking over time

- Dynamic weighting based on historical accuracy

Risk Management System

- Position limit calculations

- Volatility-based stop-loss recommendations

- Portfolio-level risk assessment

- Correlated position identification

- Maximum drawdown projections

- Stress testing scenarios

Backtesting Framework

- Historical performance simulation

- Agent-specific contribution analysis

- Parameter optimization tools

- Performance metrics calculation

- Strategy comparison visualizations

- Risk-adjusted return evaluation

The AI Hedge Fund represents a significant step forward in algorithmic trading by leveraging specialized AI agents inspired by legendary investors' strategies. Through its microservice architecture and sophisticated intercommunication system, the platform enables complex market analysis across technical, fundamental, and sentiment dimensions, leading to high-confidence trading decisions and optimized portfolio management.